Chartink to TradingView: A Comprehensive Guide to Enhanced Stock Market Analysis

Introduction

In the world of stock trading, tools like Chartink and TradingView have emerged as essential resources for traders and investors. Both platforms offer unique features that cater to different trading needs, from technical analysis to stock screening. In this guide, we’ll compare Chartink to TradingView, diving into their features, differences, and how each can enhance your trading strategy. Understanding these tools can help you make informed decisions and improve your market analysis.

What is Chartink?

Chartink is a web-based platform that provides a range of stock screening and technical analysis tools specifically for the Indian stock market. It offers real-time screening, custom alerts, and technical indicators that allow users to monitor stocks effectively. Chartink is especially popular among Indian traders due to its focus on local markets and its user-friendly interface, making it an excellent choice for both beginners and experienced traders in India.

What is TradingView?

TradingView is a globally popular charting and analysis platform used by traders from various markets, including stocks, cryptocurrencies, and forex. Known for its advanced charting capabilities, TradingView provides an extensive library of technical indicators, customizable chart layouts, and social features like community-driven scripts. TradingView supports global markets, making it ideal for traders who are looking for a comprehensive platform that caters to multiple asset classes.

Comparing Chartink to TradingView: Key Differences

While both Chartink and TradingView offer powerful tools, they differ in their approach and target audience. Chartink is tailored towards the Indian stock market, focusing on ease of use and local market needs. TradingView, on the other hand, is a global platform with more advanced charting features and a larger variety of asset classes. Traders who need more extensive charting capabilities may prefer TradingView, while those focused on the Indian market might find Chartink sufficient.

Why Use Chartink for Stock Screening?

Chartink excels in stock screening, offering real-time screeners for NSE stocks. Its custom filter feature allows users to create unique screeners based on various technical indicators and financial ratios. For Indian traders who focus primarily on stock screening, Chartink is highly effective as it simplifies the process of finding stocks that meet specific criteria. It’s an excellent tool for identifying trading opportunities in the Indian market quickly.

Why Use TradingView for Technical Analysis?

For traders seeking a platform with sophisticated technical analysis tools, TradingView is a solid choice. With its wide range of indicators, drawing tools, and customizable chart layouts, TradingView allows users to perform in-depth technical analysis. TradingView also supports various global markets, making it suitable for traders who analyze multiple asset classes. Its community-driven features, like shared scripts, add value by providing access to unique strategies and insights.

How to Integrate Chartink to TradingView for Improved Analysis

While there isn’t a direct integration between Chartink and TradingView, users can still use both platforms together to enhance their trading strategy. For instance, you can use Chartink to screen for potential stocks and then analyze those stocks in-depth on TradingView. This combination allows traders to utilize the strengths of both platforms – Chartink for quick screening and TradingView for advanced charting – to make more informed decisions.

Chartink to TradingView: Which One Should You Choose?

Choosing between Chartink and TradingView depends on your trading needs and focus areas. If you are an Indian trader primarily looking for stock screeners and simple indicators, Chartink might be enough. However, if you need advanced charting tools, access to global markets, or community-driven features, TradingView could be the better option. Many traders find that using both platforms simultaneously offers the best of both worlds, combining quick screening with advanced analysis.

Tips for Getting the Most Out of Chartink

To maximize the benefits of Chartink, consider using its custom filter options to create screeners that align with your trading strategy. Chartink’s alert feature is also valuable for keeping track of stocks that meet your criteria in real time. By setting up alerts and refining your screening criteria, you can identify trading opportunities more effectively, making Chartink an essential tool for quick decision-making in the Indian market.

Tips for Getting the Most Out of TradingView

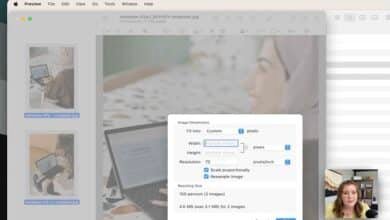

For those who choose TradingView, leveraging its extensive charting tools is crucial. Experimenting with different indicators, creating multiple chart layouts, and exploring community scripts can enhance your analysis. TradingView’s replay feature is another useful tool for testing strategies, as it allows you to review historical price movements. Taking advantage of these features can elevate your trading experience and help you develop a more robust strategy.

Conclusion

In conclusion, both Chartink and TradingView are valuable tools for traders, each offering unique advantages. Chartink’s focus on the Indian stock market and ease of use makes it ideal for local traders who need effective stock screening. TradingView, with its advanced charting capabilities and global reach, is perfect for traders who require a comprehensive analysis platform. By using both platforms together, you can combine quick screening with detailed analysis, ultimately enhancing your trading strategy and making more informed decisions.

FAQs

Q1. Can I use Chartink and TradingView together?

A1. Yes, many traders use Chartink for screening and TradingView for advanced chart analysis, combining both tools for optimal results.

Q2. Is Chartink suitable for international markets?

A2. No, Chartink is focused on the Indian stock market. For international markets, TradingView is a better option.

Q3. Do I need a subscription for TradingView?

A3. TradingView offers both free and premium plans. Advanced features like multiple indicators and alerts require a subscription.

Q4. Can TradingView screen stocks like Chartink?

A4. TradingView has screening options, but they are not as tailored to the Indian market as Chartink’s screeners.

Q5. Which platform is better for beginners, Chartink or TradingView?

A5. Chartink is more beginner-friendly for Indian markets, while TradingView offers more advanced tools that may suit experienced traders.