Jindal Steel Share Price Insights: A Complete Guide for Investors

Investing in the stock market can seem daunting, especially for beginners. However, understanding key factors that influence share prices and using the right tools can help make informed decisions. Jindal Steel share price, one of India’s most prominent steel manufacturers, is a popular stock among investors. In this article, we will take a deep dive into Jindal Steel share price, analyze insights from Chartink, and explore the key factors affecting its value in the stock market.

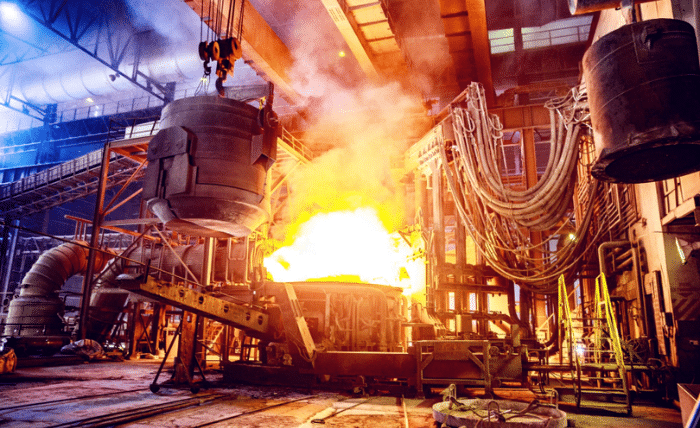

What is Jindal Steel?

Jindal Steel and Power Limited (JSPL) is a leading steel manufacturing company in India, recognized for producing high-quality steel products. It is involved in the production of long steel, flat steel, and power, with a significant presence in the infrastructure and manufacturing sectors. Jindal Steel’s products are widely used in industries such as construction, automotive, energy, and engineering.

The company has a strong market presence and plays a significant role in India’s industrial growth. When discussing Jindal Steel share price, investors are interested in tracking how the company’s stock is performing on the market, as its stock price reflects the financial health and overall market perception of Jindal Steel share price.

Why is Jindal Steel Share Price Important?

The Jindal Steel share price serves as a crucial indicator of the company’s financial performance and market valuation. Understanding the movements of its share price is essential for investors because it helps them determine whether the stock is a good buy, sell, or hold. Several factors contribute to the fluctuation of Jindal Steel share price, including:

Market Demand for Steel

Steel is a critical component in the construction and manufacturing industries. The price of steel, both domestically and internationally, has a direct impact on Jindal Steel’s revenues and profitability. When the global demand for steel increases, it often leads to higher prices and, consequently, an increase in the company’s earnings, which can drive up the Jindal Steel share price.

Global Economic Conditions

Steel prices are also affected by macroeconomic factors such as trade policies, global economic growth, and changes in commodity prices. For instance, a slowdown in global economic growth or trade restrictions can reduce the demand for steel, which may negatively impact the Jindal Steel share price.

Government Policies

Government policies, especially those related to infrastructure development and manufacturing, play a significant role in shaping Jindal Steel share price prospects. Positive policies, such as increased spending on infrastructure or reduced duties on steel imports, can benefit Jindal Steel’s performance and drive its share price upward.

Company’s Financial Performance

Jindal Steel’s quarterly earnings reports and overall financial health are closely monitored by investors. Strong earnings, improved profitability, and growth in revenue are all indicators that can lead to a positive movement in the Jindal Steel share price. Conversely, poor financial performance can have the opposite effect, leading to a decline in Jindal Steel share price.

Industry Competition

Competition in the steel industry also impacts Jindal Steel’s market position. The company must maintain its competitive edge in terms of production costs, product quality, and technological advancements. If Jindal Steel faces intense competition, especially from international players, it could affect its profitability and Jindal Steel share price.

How to Analyze Jindal Steel Share Price with Chartink

Chartink is a popular platform that provides stock analysis tools, charts, and market insights. It helps investors make informed decisions by analyzing stock movements and trends. When analyzing Jindal Steel share price, investors can use several tools on Chartink to understand its performance:

Price Trends

Price trends are one of the most straightforward ways to analyze a stock. Investors can track Jindal Steel share price movements on a daily, weekly, or monthly basis. A consistent upward trend indicates strong performance, while a downward trend could signal potential concerns.

Volume Analysis

Volume refers to the number of shares traded during a specific period. On Chartink, you can track the volume of Jindal Steel share price being traded. High trading volumes often suggest strong investor interest, while low volumes may indicate a lack of confidence in the stock.

Technical Indicators

Chartink provides various technical indicators that can help investors analyze whether a stock is overbought or oversold. Common indicators include:

- Moving Averages: These helps smooth out short-term fluctuations in stock prices and provide a clearer view of the long-term trend.

- Relative Strength Index (RSI): The RSI indicates whether a stock is overbought (indicating it might be due for a price correction) or oversold (indicating potential for price recovery).

- Bollinger Bands: These bands are used to track the volatility of the stock price, helping investors understand the potential for price swings.

Stock Comparisons

Chartink also allows you to compare Jindal Steel share price with other steel companies. This can help you assess how Jindal Steel share price is performing relative to its competitors and make more informed investment decisions.

By utilizing the tools on Chartink, investors can get a clearer picture of Jindal Steel share price trends and make more confident investment choices.

Key Factors Impacting Jindal Steel Share Price

There are several internal and external factors that impact Jindal Steel share price. Let’s take a closer look at some of the most important ones:

Global Steel Demand

The demand for steel is influenced by various factors such as global construction activities, infrastructure projects, and industrial growth. When demand is high, companies like Jindal Steel benefit from increased orders and higher revenues, which can positively affect the Jindal Steel share price.

For example, infrastructure projects such as roads, bridges, and housing developments require large amounts of steel. Similarly, a boom in the automobile and manufacturing sectors can lead to higher demand for steel products, which is likely to boost Jindal Steel share price.

Economic Cycles

The broader economy plays a significant role in steel prices. During periods of economic expansion, industrial production and infrastructure projects tend to increase, leading to higher demand for steel. On the other hand, economic recessions or slowdowns can reduce steel demand, negatively affecting companies like Jindal Steel and their share price.

Raw Material Costs

Steel production is a raw material-intensive process, with key inputs such as iron ore and coal accounting for a large portion of production costs. Fluctuations in the prices of these raw materials can significantly affect Jindal Steel’s profitability. If raw material prices rise, it can put pressure on profit margins, which may in turn influence the Jindal Steel share price.

Government Policies

Government policies, especially in the realm of infrastructure and trade, can have a major impact on the steel industry. For instance, government initiatives like “Make in India” and increased spending on infrastructure projects tend to create a favorable environment for steel companies. Similarly, export-import duties and trade agreements also play a crucial role in determining the performance of steel companies and Jindal Steel share price.

Should You Invest in Jindal Steel Shares?

Deciding whether to invest in Jindal Steel share price depends on several factors, including your investment goals, risk tolerance, and market outlook. Here are some tips to help you make an informed decision:

Do Your Research

Before making any investment, it’s essential to study Jindal Steel’s financial health, historical performance, and market conditions. Reviewing quarterly earnings reports, industry trends, and global economic factors will give you a clearer picture of Jindal Steel share price prospects.

Use Reliable Tools

Platforms like Chartink provide valuable insights into the stock’s performance. By using these tools, you can track Jindal Steel share price trends, trading volumes, and technical indicators to make better investment decisions.

Diversify Your Portfolio

While investing in Jindal Steel share price can be lucrative, it’s important not to put all your money into a single stock. Diversifying your investments across different sectors can help mitigate risk and improve your portfolio’s overall performance.

Final Thoughts

Tracking the Jindal Steel share price and understanding the key factors that influence it can help you make smarter investment decisions. By utilizing platforms like Chartink and staying informed about global economic conditions, you can gain insights into the stock’s potential movements. Whether you’re a novice investor or a seasoned professional, these resources can guide you in making well-informed decisions and optimizing your portfolio.